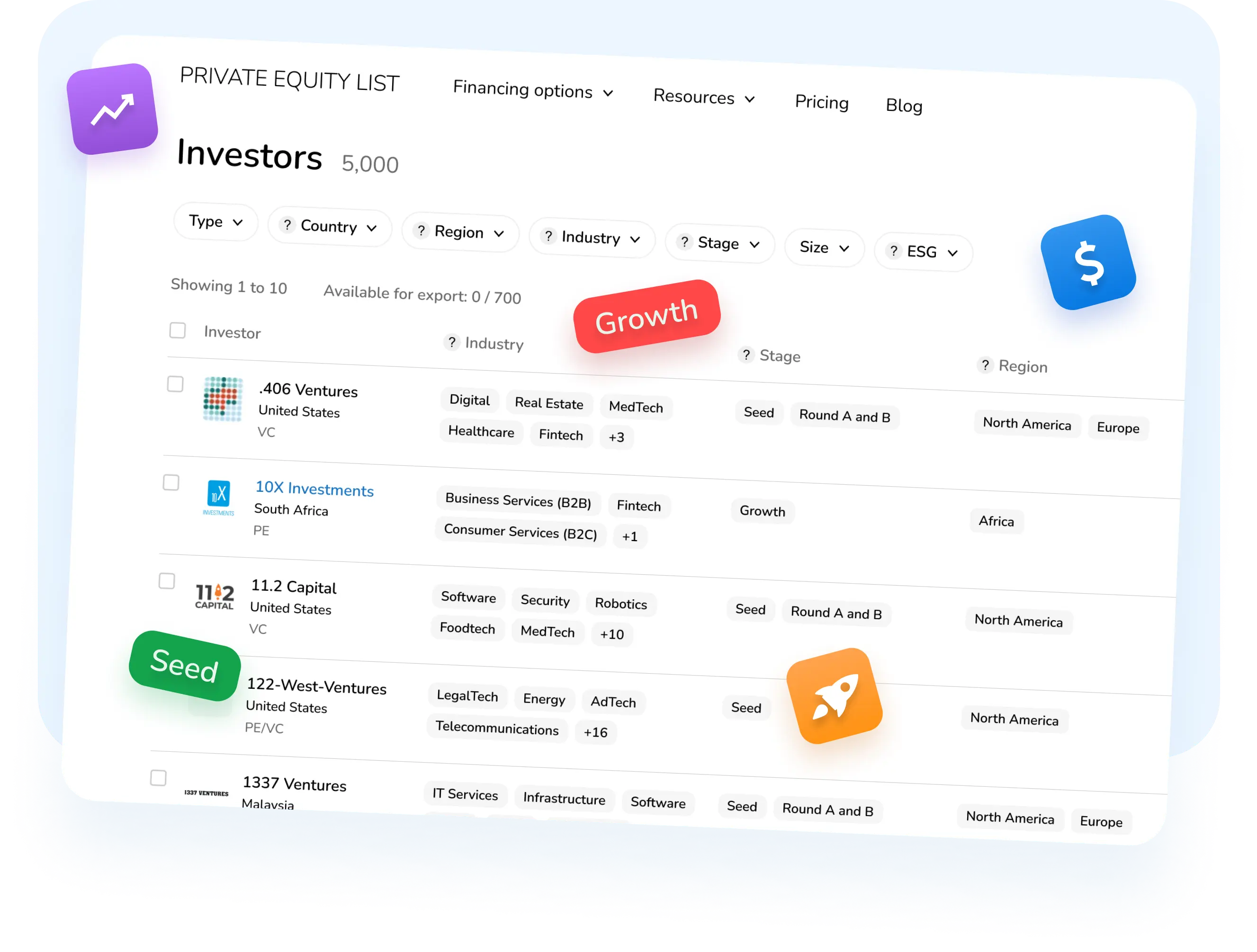

Leading database of private equity and venture capital investors at your fingertips

PrivateEquityList.com is a fast and easy-to-use platform to identify relevant private equity, venture capital and angel investors for any project, startup or a mature company.

6,204

PE/VC funds globally

Middle East, Africa, APAC

Global coverage with focus on

23,899

Contacts of investment teams

Financing options

Find and choose the right financing type for your project / startup from numerous financing options consolidated in one place

Premade lists

Already prepared investors list for hot industries

Edtech

1,634 PE/VC funds

Gaming

895 PE/VC funds

E-commerce

668 PE/VC funds

Cannabis

99 PE/VC funds

Robotics

886 PE/VC funds

SaaS

839 PE/VC funds

Fintech

3,722 PE/VC funds

Blockchain

540 PE/VC funds

AI

574 PE/VC funds

Impact investor

185 PE/VC funds

People of color

67 PE/VC funds

Women

124 PE/VC funds

Promote your fund

Build trust and improve communication for your fund's success.

Attract interesting projects

Increase trust and transparency

Strengthen image and competitiveness

What our users say

How Private Equity List helps professionals around the world

Supercharge your fundraising!

Find the perfect private equity, venture capital and angel investors for your project or company. Access a comprehensive database, advanced search and filters. Unlock funding opportunities and reach new heights.

FAQ

If our FAQ has no answers to your inquiries, just play with the website around some more. It is very simple

2. We have database of PE/VC funds that support women, LGBTQ and other minorities.

3. We focus on non-popular geographical regions such as MENA, APAC and even exotic regions where investor information is scattered and scarce (unlike in US/EU). Have you ever tried to find list investors of that operate in Bangladesh or Philippines? That’s not an easy task.

■ Startup founder searching for investors and seed financing

■ Investment research professional

■ Corporate finance consultant who is compiling a list of investors for your client

and anyone else who wants structured investor information.

1. Time. Just filter the investment criteria and get your investor contact list and save weeks of search.

2. Money. No need to pay money for uncertain results.

Focus on your startup!