Venture Capital Firms: The Ultimate Guide (2024)

Are you an entrepreneur seeking funding for your startup? Or maybe you're an aspiring venture capitalist looking to get involved in the industry? In either case, this comprehensive guide is here to provide you with the knowledge and resources you need for success in the world of venture capital.

From understanding what venture capital is and how it works, to exploring key sectors and industries, identifying major players, and uncovering the challenges and risks involved, this guide will give you valuable insights into the exciting and ever-evolving landscape of venture capital.

Introduction to Venture Capital

In this section, we will provide an introduction to venture capital, explaining what it is and how it works. Venture capital is a form of funding that is provided to early-stage startups and high-growth companies by investors known as venture capitalists. The goal of venture capital is to support these companies in their growth and development by providing not just capital but also mentorship, networking opportunities, and strategic guidance.

What is Venture Capital?

Venture capital is a type of private equity investment that focuses on investing in startups and small businesses with high growth potential. Unlike traditional forms of financing such as bank loans or public offerings, venture capital is typically provided by individual investors or venture capital firms who are willing to take on high levels of risk in exchange for potential high returns.

The Evolution of Venture Capital

The concept of venture capital has its roots in the early 20th century, but it wasn't until the mid-20th century that the industry started to take shape. In the 1950s and 1960s, venture capital firms began to emerge in the United States, primarily focused on funding companies in the technology sector. Over the years, venture capital has evolved and grown into a global industry, supporting innovation and entrepreneurship in various sectors and geographies.

Why Venture Capital Matters

Venture capital plays a crucial role in the startup ecosystem and the overall economy. It provides the necessary capital and resources for startups to turn their ideas into viable businesses. By investing in startups, venture capitalists not only help individual entrepreneurs and companies but also contribute to job creation, innovation, and economic growth. Venture capital also fosters a culture of risk-taking and innovation, driving progress and societal development.

Understanding the Venture Capital Process

When it comes to venture capital, understanding the process is key to navigating the world of startup funding. From pitching ideas to securing investment, this section will guide you through the ins and outs of venture capital.

How Venture Capital Works

Venture capital involves the investment of funds into high-potential startups with the expectation of significant returns. Venture capitalists provide both capital and expertise to help startups scale and succeed. Their goal is to identify businesses with high growth potential and help them achieve their goals.

Stages of Venture Capital Funding

Startups typically go through several stages of venture capital funding as they progress from early-stage development to becoming established companies. These stages include:

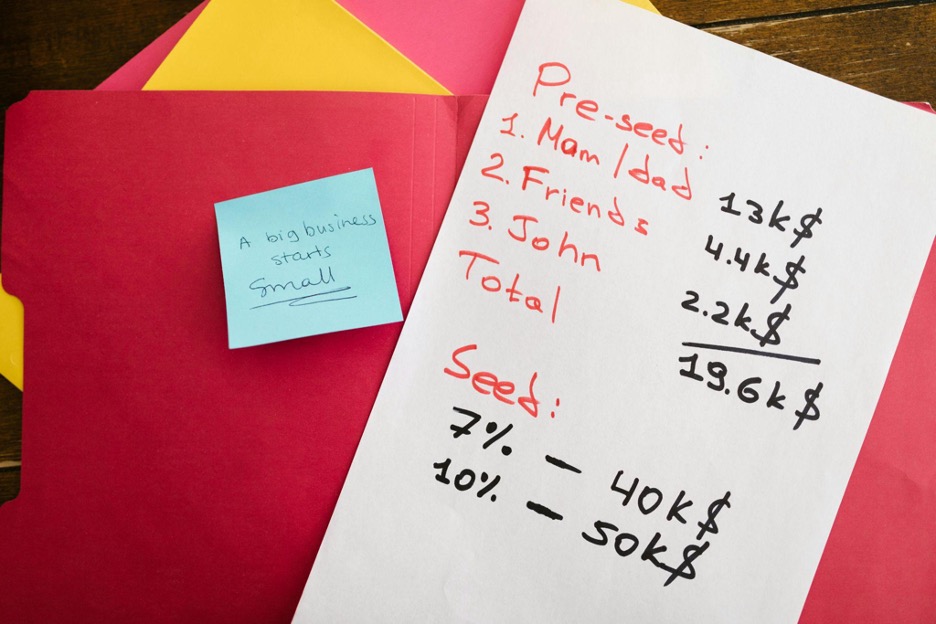

1. Seed Stage: At this early stage, investors provide funding to help startups get off the ground. This funding is usually used to develop a product or service prototype and conduct market research.

2. Series A: In this stage, startups receive more substantial funding to refine their product, build their team, and scale their operations. Venture capitalists often invest in exchange for equity in the company.

3. Series B and Beyond: As startups continue to grow, they may require additional funding to expand their market presence or enter new markets. Series B, C, and subsequent rounds of funding are aimed at fueling this growth.

The Role of a Venture Capitalist

A venture capitalist plays a crucial role in the startup ecosystem. They not only provide financial backing but also offer guidance, mentorship, and industry connections. Venture capitalists carefully evaluate investment opportunities and make decisions based on the startup's potential for growth, market demand, and the team's capabilities.

Pitching to Venture Capitalists: What You Need to Know

Pitching to venture capitalists is a critical step in securing funding for your startup. To increase your chances of success, it's essential to prepare a compelling pitch deck and deliver a persuasive presentation. Here are a few things to keep in mind:

- Clearly articulate your business idea and its unique value proposition.

- Highlight your market opportunity and demonstrate a deep understanding of your target audience.

- Showcase your team's expertise and track record

- Discuss your go-to-market strategy and outline your plans for scalability

- Provide financial projections and discuss the potential return on investment for venture capitalists.

By following these tips and understanding the venture capital process, you'll be well-equipped to navigate the funding landscape and secure the investment needed to take your startup to new heights

Key Sectors and Industries for Venture Capital

In the world of venture capital, different sectors and industries attract significant investment due to their potential for growth and innovation. Venture capitalists actively seek opportunities in these sectors, funding promising startups and driving technological advancements. In this section, we will explore some of the key sectors and industries that are particularly attractive to venture capital.

Technology

The technology sector is undoubtedly one of the dominant forces in venture capital funding. From software and hardware development to internet-based platforms and disruptive innovations, technology-driven startups constantly push boundaries and offer high growth potential. Venture capitalists recognize the transformative power of technology and heavily invest in this sector to support the next wave of innovation.

Healthcare

The healthcare industry is another sector that garners significant venture capital attention. With advancements in medical technology, digital health solutions, and personalized medicine, startups in this sector have the potential to revolutionize healthcare delivery and improve patient outcomes. Venture capitalists recognize the immense value of disruptive healthcare startups and are eager to provide the necessary funding for their growth and expansion.

Green Energy and Sustainability

In recent years, there has been growing interest in green energy and sustainability-focused startups. As the world faces the challenges of climate change, venture capitalists are keen to invest in innovative solutions that promote renewable energy, efficient resource utilization, and environmental sustainability. Startups in this sector are not only driving positive change but also have the potential for substantial financial returns, making it an attractive market for venture capital investment.

FinTech

The financial technology sector, commonly known as FinTech, has been experiencing significant growth and disruption. Startups in this sector leverage technology to revolutionize traditional financial services, offering solutions such as digital payments, peer-to-peer lending, robo-advisory platforms, and blockchain-based innovations. Venture capitalists see the potential for immense value creation in FinTech startups and actively seek investment opportunities to support their growth.

Emerging Sectors

Beyond the well-established sectors, venture capitalists also keep a watchful eye on emerging sectors that show great potential for growth and innovation. These could include emerging technologies like artificial intelligence, machine learning, robotics, virtual reality, and augmented reality, as well as emerging industries such as e-commerce, edtech, foodtech, and biotechnology. Venture capitalists are always on the lookout for disruptive startups that can make an impact and create new market opportunities.

The Top 10 Venture Capital Firms (Quick Summary)

As the global venture capital investment market soared to a valuation of US$ 233.9 Billion in 2022, curiosity about the leading figures in the sector has grown. Below is an overview of the 10 foremost venture capital firms in 2023.

| Rank | Firm Name | AUM (in billions, approximate) |

|---|---|---|

| 1 | Sequoia Capital | $28 |

| 2 | Andreessen Horowitz (a16z) | $35 |

| 3 | Khosla Ventures | $15 |

| 4 | Accel Partners | $50 |

| 5 | kleiner Perkins | $6.8 |

| 6 | Greylock Partners | $3.5 |

| 7 | Index Ventures | $13 |

| 8 | New Enterprise Associates (NEA) | $20 |

| 9 | Founders Fund | $11 |

| 10 | Tiger Global Managment | $125 |

The Assets Under Management (AUM) figures presented in this table are approximate values and serve as a representation of the size and scale of the respective large private equity firms as of February 2024. It's important to understand that these figures are subject to change due to private markets fluctuating, investment performance, and the firms' ongoing activities. While we strive to provide accurate and up-to-date information, the dynamic nature of the financial industry means that the actual AUM and rankings can vary over time. For the most current information, we recommend consulting directly with the firms in question or referring to their official communications.

The Top 10 Venture Capital Firms (Detailed Profiles)

Sequoia Capital

Sequoia Capital, headquartered in Menlo Park, California, is a titan in the venture capital industry, known for backing companies that now control $1.4 trillion of the stock market's value. With a broad portfolio that includes technology giants like Apple, Google, and Airbnb, Sequoia has been shaping the tech landscape since 1972. The firm's global presence supports entrepreneurs around the world, from seed stage through IPO.

Andreessen Horowitz (a16z)

Based in Silicon Valley and founded in 2009 by Marc Andreessen and Ben Horowitz, Andreessen Horowitz (a16z) is a venture capital firm that invests in early to late-stage tech companies. Known for its proactive support of portfolio companies and a vast network of tech industry contacts, a16z manages billions in assets and has made significant investments in leading technology companies like Facebook, Airbnb, and Coinbase.

Khosla Ventures

Khosla Ventures is a venture capital firm founded by Vinod Khosla, co-founder of Sun Microsystems, with a focus on a wide range of technology sectors, including renewable energy, biomedicine, robotics, and Internet technology. Based in Menlo Park, California, Khosla Ventures is known for its willingness to take bold risks on innovative startups aiming to have a significant impact. The firm's philosophy centers on supporting entrepreneurs through their journey from inception to market leadership, leveraging Khosla's extensive experience and network.

Accel Partners

Accel, with its headquarters in Palo Alto, California, has been a key player in venture capital since 1983. Focused on early and growth-stage investments, Accel has helped iconic companies like Facebook, Slack, and Spotify grow from startups to global enterprises. Its global reach, with offices in London and Bangalore, underscores Accel's commitment to building lasting companies across various sectors.

Kleiner Perkins

A pioneer in the venture capital industry, Kleiner Perkins was founded in 1972 and is based in Menlo Park, California. It has been behind the creation and growth of companies that have become household names, such as Amazon, Google, and Twitter. Kleiner Perkins offers startups not only financial investment but also strategic advice and access to an expansive network, focusing on green technology, life sciences, and the Internet.

Greylock Partners

Established in 1965 and based in Menlo Park, Greylock Partners is one of the oldest venture capital firms, known for investing in early-stage companies and supporting them through their growth journey. With investments in industry leaders like LinkedIn, Airbnb, and Facebook, Greylock's approach is to partner closely with entrepreneurs to build companies that last.

Index Ventures

Index Ventures, headquartered in London and San Francisco, focuses on technology and biotechnology investments across early and growth stages. Since its inception in 1996, Index has backed innovative companies like Dropbox, Adyen, and Slack, offering international perspectives and a commitment to building ambitious companies.

New Enterprise Associates (NEA)

New Enterprise Associates (NEA) is one of the world's largest and most diversified venture capital firms, with over $20 billion in committed capital across its funds. NEA invests in information technology, healthcare, and energy technology, supporting entrepreneurs at nearly every stage of their company's lifecycle. Founded in 1977, NEA has a long history of investing in groundbreaking companies and has helped nurture hundreds of startups into industry leaders, operating from its headquarters in Menlo Park, California, and other global locations.

Founders Fund

Founders Fund is a San Francisco-based venture capital firm that has made a name for itself by investing in companies that push the boundaries of their industries. Founded by PayPal co-founder Peter Thiel in 2005, Founders Fund prefers to invest in startups that are tackling complex challenges with the potential to disrupt sectors or create entirely new markets. The firm's portfolio includes some of the most notable names in technology, including SpaceX, Palantir, and Facebook. Founders Fund is known for its founders-first approach, prioritizing the vision and leadership of entrepreneurs in its investment strategy.

Tiger Global Management

Tiger Global Management is a New York-based investment firm that blends focus on both private equity and public equity markets, making it a formidable force in venture capital and hedge fund investment. Founded in 2001 by Charles "Chase" Coleman III, Tiger Global has become one of the most aggressive and successful investors in technology startups globally, with a keen eye for identifying high-growth companies in the Internet, software, consumer, and financial technology sectors. Its approach is characterized by making large, concentrated bets and actively supporting management teams of its portfolio companies to scale internationally.

These top venture capital firms leverage their financial resources, industry expertise, and extensive networks to discover and support promising startups around the world. Their investments not only provide startups with the capital they need to grow but also offer valuable guidance and mentorship to help them succeed.

The Impact of Technology on Venture Capital

The rapid advancement of technology has had a profound impact on the world of venture capital. From artificial intelligence and machine learning to blockchain and cryptocurrency, these cutting-edge technologies are revolutionizing the way startups are funded, evaluated, and supported.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) have emerged as powerful tools in the venture capital industry. These technologies enable venture capitalists to analyze vast amounts of data and make data-driven investment decisions. AI and ML algorithms can identify patterns, trends, and potential investment opportunities with greater accuracy and efficiency than traditional methods.

Through AI-powered analytics, venture capitalists can gain valuable insights into market trends, customer behavior, and competitive landscapes. This not only helps in identifying promising startups but also allows for more effective portfolio management and risk assessment. AI and ML technologies are leveling the playing field and democratizing access to venture capital, opening up opportunities for a wider range of founders and startups.

Blockchain and Cryptocurrency

The advent of blockchain technology and cryptocurrencies has brought significant changes to the venture capital landscape. Blockchain technology, with its decentralized and secure nature, has the potential to disrupt traditional fundraising models. Startups can now raise capital through initial coin offerings (ICOs) or security token offerings (STOs), providing investors with an alternative way to participate in early-stage investments.

Cryptocurrencies, such as Bitcoin and Ethereum, have also gained traction as investment assets for venture capitalists. These digital assets provide liquidity, efficient cross-border transactions, and reduced transaction costs. Venture capitalists can diversify their portfolios by investing in blockchain-based projects and cryptocurrencies, enabling them to tap into new markets and opportunities.

The Role of Data Analytics

Data analytics plays a critical role in venture capital decision-making. With the increasing availability of data, venture capitalists can leverage advanced analytics techniques to evaluate startups and assess their growth potential. By analyzing key performance indicators, financial metrics, and market trends, venture capitalists can make informed investment decisions.

Data analytics also enables venture capitalists to track the progress and performance of their portfolio companies. They can monitor key metrics in real-time, identify potential issues early on, and provide guidance and support to help startups achieve their growth objectives.

Moreover, data analytics can enhance due diligence processes, allowing venture capitalists to evaluate startups more efficiently and objectively. By harnessing the power of data, venture capitalists can mitigate risks and increase the likelihood of successful investments.

Challenges and Risks in Venture Capital

In the world of venture capital, there are various challenges and risks that both investors and startups need to be aware of and navigate, particularly when deciding which startup companies to invest in. Understanding and addressing these challenges is essential for success in the competitive landscape of venture capital.

Identifying and Mitigating Risks

One of the key challenges in venture capital is identifying and mitigating risks associated with potential investment opportunities. Venture capitalists need to conduct thorough due diligence on startups to assess their financial health, market potential, and management team. This helps them understand the risks involved and make informed investment decisions.

Investors also need to have a clear risk mitigation strategy in place. This involves diversifying their portfolio to reduce the impact of any potential losses and staying updated on market trends and shifts. By understanding the risks and actively managing them, venture capitalists can increase their chances of achieving successful returns.

The Impact of Economic Fluctuations

Economic fluctuations pose another significant challenge in the realm of venture capital. The success of startups is closely tied to the overall economic climate, with downturns often leading to reduced funding opportunities and increased difficulties in exiting investments.

During economic downturns, venture capitalists may face challenges in raising new funds, as investors become more risk-averse. This can limit the amount of capital available for investments and lead to a more competitive landscape for startups seeking funding.

Conversely, economic upturns can create an ideal environment for venture capital investments, with increased access to capital and heightened investor confidence. However, these periods also bring their own risks, such as inflated valuations and intensified competition for promising startups.

Regulatory Challenges

Regulatory challenges are yet another important aspect of the venture capital industry. As the startup ecosystem evolves, new regulations and compliance requirements often emerge, posing additional hurdles for both investors and startups.

Regulatory changes can impact various aspects of the venture capital process, including fundraising, investment structures, and exit strategies. Staying up to date with these regulations and ensuring compliance can be complex and time-consuming.

Startups and venture capitalists need to navigate these regulatory challenges carefully, seeking legal advice when necessary and implementing robust compliance practices. This helps mitigate the risks of potential penalties or legal issues and ensures that all parties involved are operating within the boundaries of the law.

In conclusion, venture capital investments come with their fair share of challenges and risks. By identifying and mitigating risks, understanding the impact of economic fluctuations, and navigating regulatory challenges, both investors and startups can increase their chances of success in the dynamic world of venture capital.

The Future of Venture Capital

In this section, we will delve into the future of venture capital and explore the predictions for the venture capital landscape in the coming years. We will also discuss the role of venture capital in driving global innovation and its impact on emerging markets.

Predictions for the Venture Capital Landscape

The venture capital industry is constantly evolving, and there are several predictions for its future. One notable prediction is the continued growth of venture capital investments, as more investors recognize the potential for high returns in this asset class. With the rise of technology-driven businesses and the increasing need for innovative solutions, venture capital will likely play a crucial role in funding and supporting these startups.

Another prediction is the emergence of new investment models and strategies in venture capital. Traditional venture capital funds may face competition from alternative models, such as crowdfunding platforms and corporate venture capital. These new models are expected to bring about changes in the way investments are made, making venture capital more accessible to a broader range of entrepreneurs and investors.

Furthermore, there is a growing focus on diversity and inclusion in the venture capital industry. In the future, we can expect to see increased efforts to fund and support underrepresented founders and startups. This shift towards diversity aims to foster innovation and tap into untapped talent, leading to a more inclusive and dynamic startup ecosystem.

The Role of Venture Capital in Global Innovation

Venture capital plays a crucial role in driving global innovation. By providing funding, expertise, and mentorship, venture capitalists enable startups to develop groundbreaking technologies and solutions that address various global challenges. These innovations have the potential to transform industries, improve quality of life, and drive economic growth.

Additionally, venture capital acts as a catalyst for collaboration and knowledge exchange on a global scale. Through international investments and partnerships, venture capitalists facilitate the transfer of ideas, talent, and resources across borders. This cross-pollination of innovation not only benefits startups but also promotes global competitiveness and economic development.

Emerging Markets and Venture Capital

Emerging markets are becoming increasingly attractive for venture capital investments. These markets offer immense growth potential, untapped consumer markets, and a wealth of entrepreneurial talent. Venture capitalists are recognizing the opportunities in emerging markets and are actively seeking out startups in these regions.

One key aspect of venture capital in emerging markets is impact investing, with many VC firms focusing on how to invest in companies that offer both financial returns and social/environmental benefits. Venture capitalists are not only focused on financial returns but also on making a positive social and environmental impact. They are investing in startups that address pressing challenges in healthcare, education, clean energy, and more, with the aim of driving inclusive growth and sustainable development in these markets.

In conclusion, the future of venture capital holds exciting prospects. With continued growth, evolving investment models, and a focus on global innovation and emerging markets, venture capital will play a vital role in shaping the startup ecosystem and driving positive change in the world.

How to Get Involved in Venture Capital

If you're an aspiring entrepreneur with a groundbreaking idea and in need of funding, venture capital can be a game-changer for your startup. Here are some key tips to help you navigate the world of venture capital and attract investment:

For Entrepreneurs

1. Build a strong pitch: Craft a compelling story around your idea, showcasing its unique value proposition, market potential, and your team's expertise. Highlight the problem you're solving and how your solution stands out from competitors, an essential part of your business plan for attracting venture partners.

2. Establish connections: Networking is crucial in the venture capital world. Attend industry events and conferences, join startup communities, and leverage social media platforms to connect with potential investors. Building relationships and gaining introductions can greatly increase your chances of securing funding.

3. Do your due diligence: Research venture capital firms that align with your industry and stage of development. Study their portfolio companies to understand their investment criteria and track record. Tailor your pitch to align with their investment thesis to increase your chances of success.

For Aspiring Venture Capitalists

1. Develop industry expertise: Being knowledgeable about specific sectors and industries will help you identify high-potential startups and evaluate their potential for success, a crucial aspect for any vc firm or venture partners. Stay informed about market trends, emerging technologies, and disruptive business models.

2. Network with investors: Connect with experienced venture capitalists through industry events, seminars, and online forums. Seek mentorship and guidance from seasoned professionals who can provide valuable insights and help you build your network within the venture capital community.

3. Stay up-to-date with deal flow: To succeed as a venture capitalist, you need a robust deal flow. Stay active in the startup ecosystem, engage with entrepreneurs, and regularly review investment opportunities. Network with accelerators, angel investors, and other key players to stay in the loop and potentially find opportunities to work with a VC firm.

By following these steps, entrepreneurs can increase their chances of securing venture capital funding, while aspiring venture capitalists can position themselves to identify and invest in tomorrow's successful startups.

Before you go..

As you reach the end of this ultimate guide to Venture Capital in 2024, you've gained a wealth of knowledge about the top firms leading the industry, the core principles of venture capital investment, and the significant impact these entities have on global business landscapes.

This journey doesn't have to stop here. Continue exploring the dynamic world of investments by diving into another one of our insightful posts or by visiting Private Equity List for the latest and most detailed investor information on VC firms and startup companies.

Whether you're looking to invest or seeking investment, the opportunities are vast and varied. Let your next investment decision be informed and inspired by the wealth of resources at your fingertips.

Related Articles:

- Unveiling the Global Landscape of Foodtech VC Investments🍔

- Unleashing Innovation: Revolutionizing Sports Through Venture Capital🚴♀️🚀

- Unveiling the Middle East Venture Capital Landscape: A Deep Dive into UAE, Bahrain, Saudi Arabia, and Oman

- Startup Equity Guide: What Are The Differences Between Regular And Advisory Shares?

- Top Private Equity Firms: The Ultimate Guide (2024)

About Private Equity List

Private Equity List is a top choice for finding investment opportunities in new markets. It's a straightforward and detailed site for people looking for private equity, venture capital, and angel investors. You don't have to sign up or subscribe to use it.

With global perspective (incl. US, EU and UK) and special focus on regions like the Middle East, Africa, Pan-Asia, and Central and Eastern Europe, Private Equity List provides vital info on investors, such as how much they invest, what regions and industries they're interested in, and how to contact key team members. This means you get everything you need to find, check out, and reach out to potential investors for your project. We also pay attention to early stage founders.

Check out Private Equity List to begin searching for investors.Our team, experienced in financial services and committed to helping businesses and entrepreneurs, keeps adding around 300 new companies to our database every month. This effort has made us a reliable source for anyone looking to find investment in markets that don't get enough attention. Check out Private Equity List to begin searching for investors.

FAQ

What is venture capital?

Venture capital, commonly referred to as investment or vc funding, is a type of investment that is provided by venture capital firms to startups or entrepreneurs to help them grow their businesses.

How does venture capital work?

Venture capital firms raise money from investors and then invest it in promising startups or early-stage companies in exchange for equity in the company. The goal is to help these companies grow and eventually provide a profitable return to the venture fund investors.

What are the differences between early-stage and late-stage venture capital investment?

Early-stage venture capital is typically provided to startups in the initial stages of development, while focusing on business development to help these companies grow and eventually go public.

What is due diligence in the context of venture capital?

Due diligence is the process through which venture capitalists evaluate and assess the potential risks and rewards of an investment opportunity before making a decision to invest.

How do venture capitalists select companies to invest in?

Venture capitalists consider various factors such as the business model, sector, team expertise, market potential, and competitive landscape when selecting companies to invest in.

What is an exit strategy in venture capital?

An exit strategy is a plan formulated by startup companies to outline their business development strategies and eventual goals to go public or secure additional rounds of funding.