Crowdfunding primer

Equity crowdfunding, crowdlending (debt) and other P2P financing options

If you prefer not to raise a debt or equity financing from a single or several conventional investors, you can turn to a more diverse and public financing type, which is a peer-to-peer (P2P) financing, or crowdfunding. This way you are getting financing from large groups of people who want to allocate their funds in projects they believe are worth investing in. Crowdfunding is usually done through special platforms that connect investors with projects and their founders. These platforms have several types of fees for the transaction, as they act as an intermediary. However, nowadays crowdfunding regulation is tightening and getting more regulated by the government, much like stock exchange. You can find a comprehensive crowdfunding guide in our crowdfunding primer.

Crowdfunding types and definitions

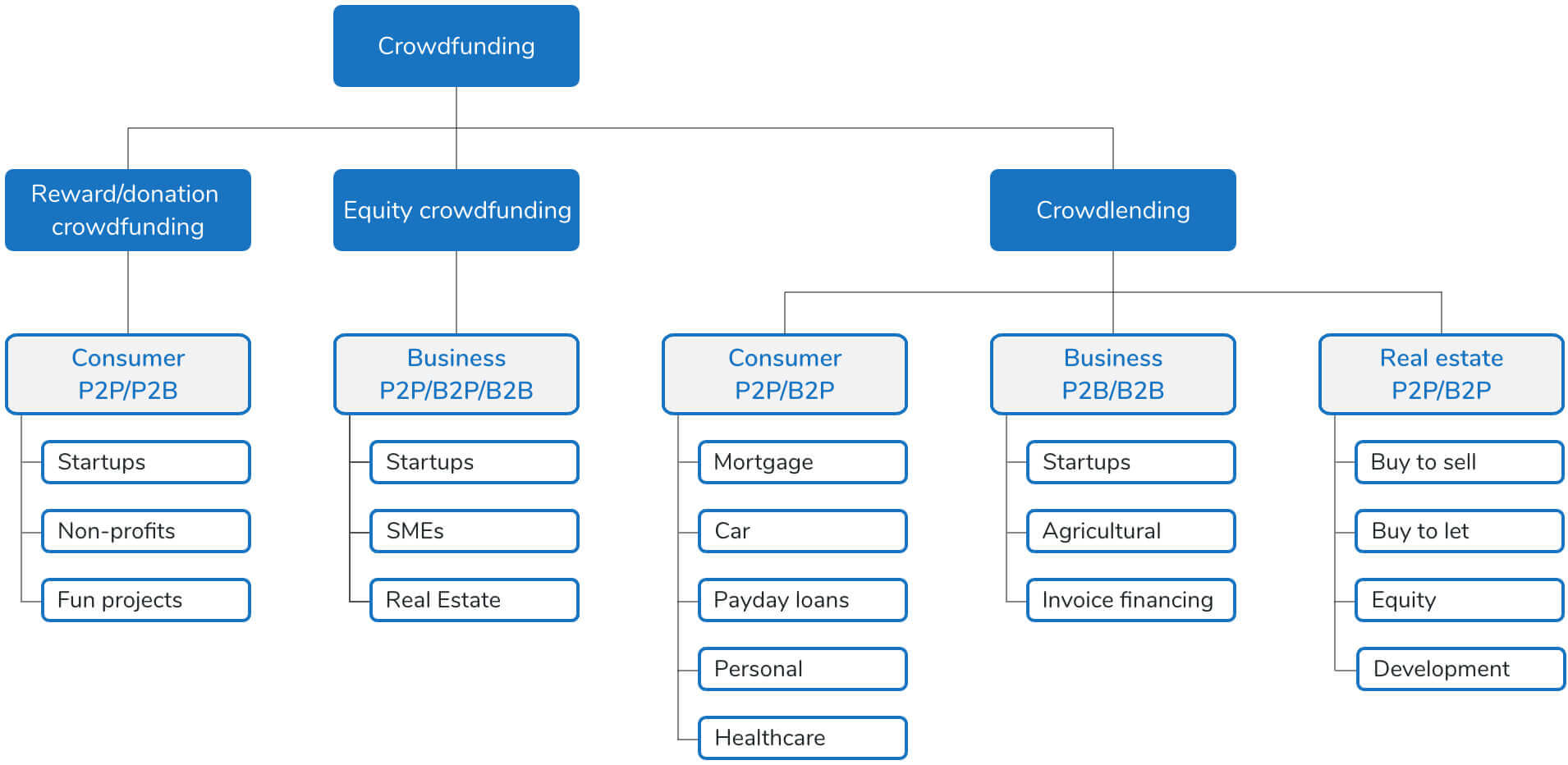

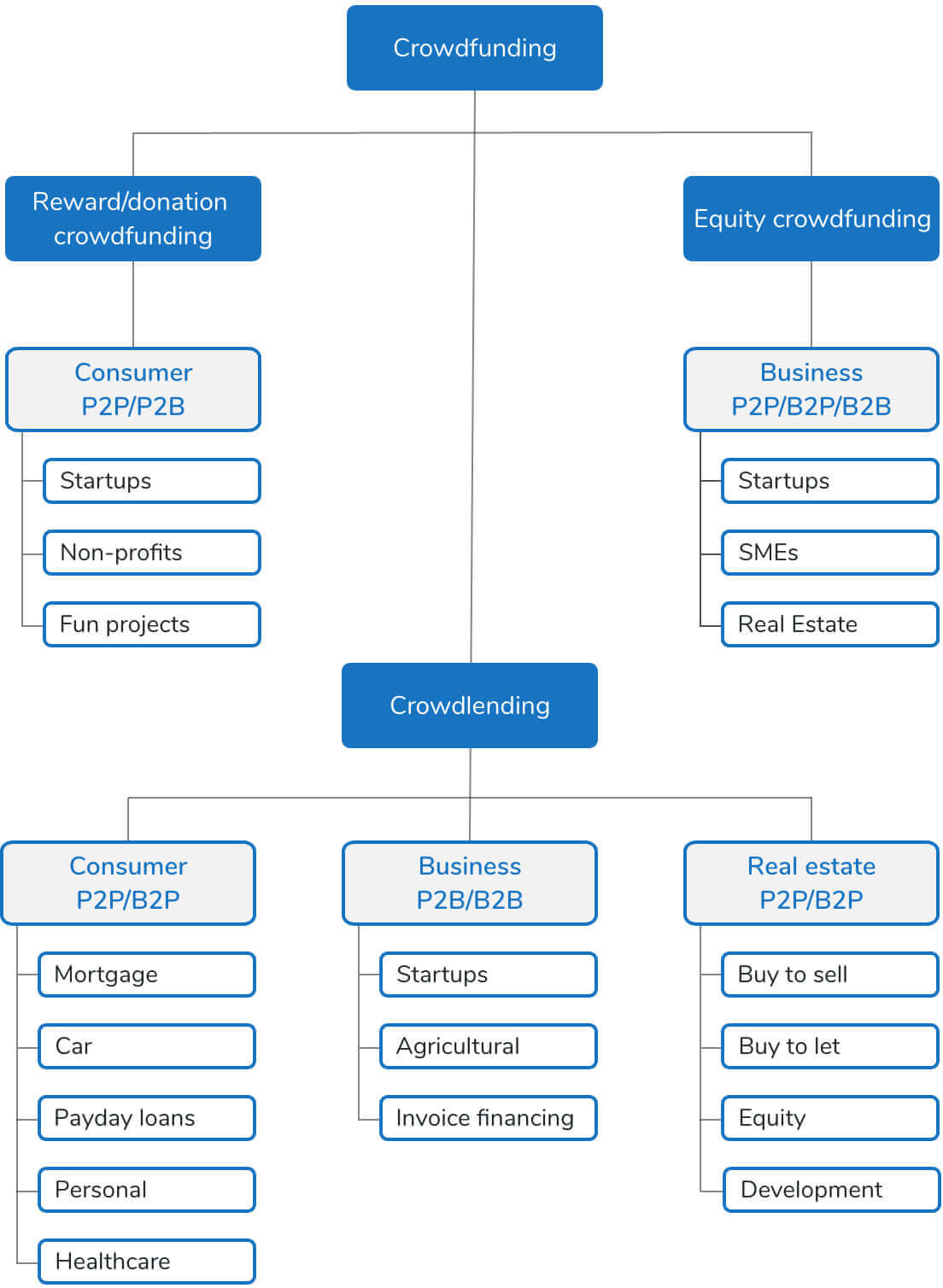

There are 3 main crowdfunding types – equity crowdfunding, crowdlending and reward/donation crowdfunding

It is important to distinguish between crowdfunding definitions

Crowdfunding regulations

Crowdfunding is regulated in most North American and European countries, rapidly developing in Asia and Latin America, and just starting in Africa. Asia, Latin America, and Africa use the experience and world’s best practices from developed countries to foster their own growth and help in developing basic crowdfunding legislation. In almost all countries there is a raise limit up for each project and maximum thresholds for accredited investors and ordinary investors alike. Below is a summary of how crowdfunding is regulated nearly in every part of the world.

Regulation status: 3 - Regulated, 2 - regulation in progress, 1 - no regulation, but limit identified,

Unshaded regions - not regulated/no data

*European Securities and Markets Authority

**Regulations in progress: Angola, Cameroon, Central African Republic, Chad, Congo, Kenya, Mauritius, Rwanda, Uganda, Equatorial Guinea, Gabon.

For other African countries - no regulations